So the rotational model is still heavy into Energy, Commodities, and Domestic Small Caps with 15% weightings, underweight Foreign Developed and Foreign Bonds, and out of Domestic Bonds as they are below their 40 week moving average.

The portfolio details are shown below for the particular asset classes mentioned above. VDE (Energy) holdings are 10% along with VB (Small Cap) and VV (Large Cap).

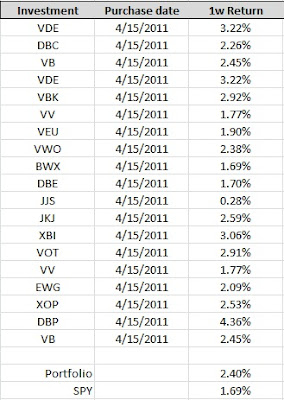

The portfolio results for the monthly trading system are shown below. Out-performance of the portfolio compared to the SPY was .62% for the week, basically recouping the under performance of the prior week.

The performance of the weekly updated performance was slightly better than the monthly portfolio. However, this was likely offset by the trading costs.

No comments:

Post a Comment